Mortgage Blog

Your Calgary and Alberta Mortgage Expert

Fixed vs Variable Rate Mortgage Canada

October 30, 2023 | Posted by: Manpriit Pabla

Unlocking the Best Mortgage: Navigating Variable vs. Fixed Mortgages in Canada

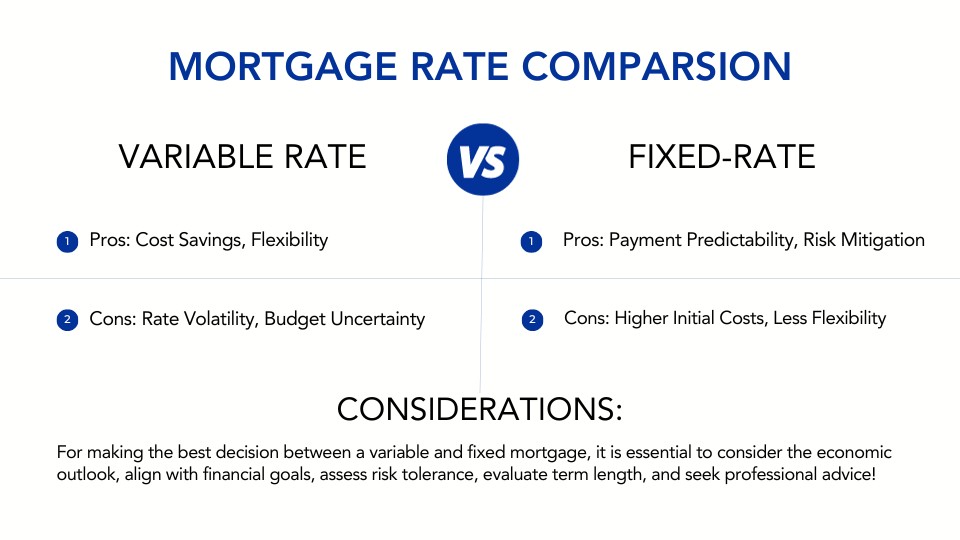

When it comes to securing a mortgage in Canada, the decision between a variable and fixed rate can significantly impact your financial future. Let's delve into the intricacies of these options to help you make an informed choice tailored to your needs.

1. Fixed Rate Mortgages: Stability in Uncertain Times

Pros of Fixed Rate Mortgages:

- - Predictable Monthly Payments: With a fixed-rate mortgage, your interest rate remains constant throughout the life of the loan. This predictability makes budgeting easier, as you'll have the same monthly payment from the day you sign the mortgage until it's paid off.

- - A Protection Against Interest Rate Increases: Fixed-rate mortgages shield you from rising interest rates. Regardless of what happens in the broader economy, your rate will remain steady. This can be particularly valuable in times of economic uncertainty.

- - Long-term Financial Planning: If you prefer the security of long-term financial planning, a fixed-rate mortgage can be the right choice. You'll always know how much of your monthly payment goes toward principal and interest.

Cons of Fixed Rate Mortgages:

- - Higher Initial Interest Rates: Fixed-rate mortgages often come with slightly higher initial interest rates than variable-rate options, which can translate to higher initial monthly payments.

- - Limited Benefit in Falling Rate Environments: When interest rates decrease, you won't benefit from lower rates unless you refinance your mortgage.

2. Variable Rate Mortgages: The Potential for Savings

Pros of Variable Rate Mortgages:

- - Lower Initial Interest Rates: Variable-rate mortgages typically start with lower interest rates than fixed-rate options, leading to lower initial monthly payments. This can be advantageous if you expect rates to remain stable or decline.

- - Potential for Interest Savings: In a falling interest rate environment, your monthly payments decrease, allowing you to pay less in interest over the life of the loan.

- - Flexibility: Some variable-rate mortgages offer flexible terms, including options to convert to a fixed-rate mortgage or make extra payments when you have the means to do so.

Cons of Variable Rate Mortgages:

- - Uncertainty: The primary drawback of variable-rate mortgages is uncertainty. Your interest rate can fluctuate with changes in the market, potentially leading to higher monthly payments and increased financial stress.

- - Budgeting Challenges: With variable rates, it's challenging to predict your long-term financial commitments. This can make budgeting more difficult, particularly for those who prefer financial stability.

3. Making the Decision: What's Best for You? Factors to Consider

When standing at the crossroads of variable and fixed mortgages, consider your risk tolerance, financial goals, and the current economic climate. Are you ready to ride the waves of market changes, or do you seek the comfort of a stable financial path?

4. Consultation is Key: Seek Professional Advice

Before making a decision, consulting with a financial advisor is paramount. Their expertise can guide you through the nuances of the Canadian mortgage landscape, ensuring your choice aligns seamlessly with your financial aspirations.

Conclusion

In the intricate world of mortgages, the choice between variable and fixed rates is a crucial decision that demands careful consideration. Whether you embrace the excitement of market fluctuations or seek the security of a fixed path, understanding the nuances of each option is the key to unlocking your financial future.